Beginner’s Guide to Forex Trading: Tips and Strategies

If you’re new to the world of Forex trading, also known as foreign exchange trading, you’re not alone. Many traders are intrigued by the potential profits and the flexibility that Forex trading offers. With a daily trading volume that exceeds $6 trillion, Forex is the largest and most liquid market in the world. For beginners, understanding the basics is essential for embarking on a successful trading journey. In this guide, we’ll cover essential concepts, practical tips, and resources to help you navigate your early days in Forex trading. Also, consider exploring options for beginner forex trading Trading Brokers in Vietnam to find the right platform for your needs.

What is Forex Trading?

Forex trading involves buying one currency while simultaneously selling another. Currencies are traded in pairs, which means that when you want to make a trade, you need to choose a pair that reflects how many units of one currency you can buy with another currency. For example, in the EUR/USD currency pair, you are looking at the value of the Euro against the U.S. Dollar.

Key Concepts in Forex Trading

1. Currency Pairs

Currencies are always traded in pairs. There are three types of currency pairs: major pairs (like EUR/USD, USD/JPY), minor pairs (like AUD/NZD), and exotic pairs (like USD/SGD). Major pairs typically have the most liquidity and the tightest spreads.

2. Pips

A pip (percentage in point) is the smallest price movement that a currency pair can make based on market convention. Most currency pairs are quoted to four decimal places, so a movement of 0.0001 is considered one pip.

3. Leverage

Leverage allows traders to control larger positions with a smaller amount of capital. While this can amplify profits, it also increases potential losses. Beginners should understand how leverage works and use it wisely.

Getting Started with Forex Trading

1. Educate Yourself

Before you begin trading, take the time to learn the basics. There are numerous online courses, books, and forums dedicated to Forex trading education. Understanding market analysis, technical indicators, and trading strategies will greatly enhance your chances of success.

2. Choose a Reputable Broker

Your choice of broker will significantly impact your trading experience. Look for brokers that are regulated, offer a user-friendly trading platform, provide educational resources, and have competitive spreads. Reading reviews and conducting thorough research on Trading Brokers in Vietnam can help you make an informed decision.

3. Create a Trading Plan

A trading plan outlines your trading goals, risk tolerance, and strategies. It should detail your entry and exit points, position sizes, and risk management rules to ensure you remain disciplined and consistent in your trading approach.

Common Trading Strategies

1. Day Trading

Day trading involves opening and closing trades within a single trading day. Day traders usually capitalize on small price movements and often employ technical analysis to predict market trends.

2. Swing Trading

Swing traders hold positions for several days or weeks, aiming to profit from medium-term price movements. This strategy requires patience and a good understanding of market trends.

3. Scalping

Scalping is a high-frequency trading strategy where traders aim to make small profits from numerous trades throughout the day. This requires quick decision-making and a solid grasp of technical analysis.

Risk Management

Risk management is crucial in Forex trading. Here are some strategies to protect your trading capital:

- Set Stop-Loss Orders: A stop-loss order automatically closes your position at a predetermined level, minimizing potential losses.

- Diversify Your Portfolio: Don’t put all your capital into a single trade or currency pair. Diversifying can help spread risk.

- Set Realistic Goals: Set achievable profit targets and be prepared for losses. This mindset will help maintain emotional discipline.

Tools and Resources for Beginners

Utilizing tools and resources can enhance your trading experience. Consider the following:

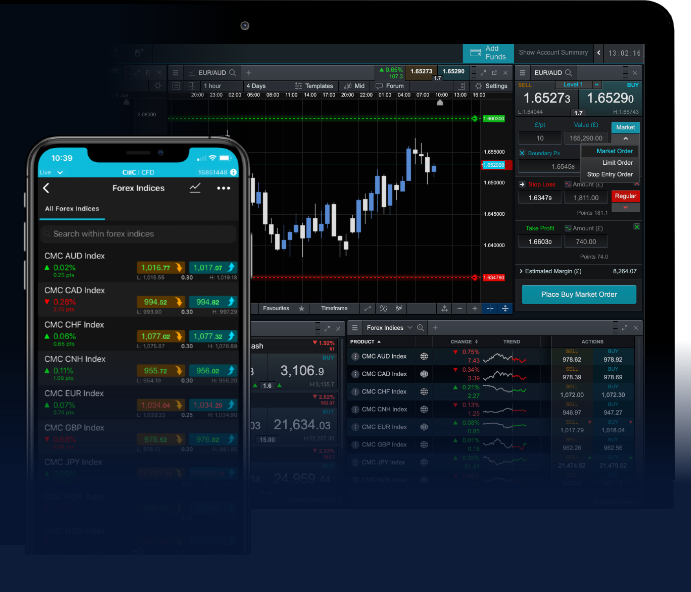

- Forex Trading Platforms: Look for platforms that provide extensive charting tools, live news, and analysis features.

- Economic Calendar: Keep track of significant economic events that can affect currency prices.

- Demo Accounts: Many brokers offer demo accounts that allow beginners to practice trading without risking real money.

Conclusion

Forex trading can be a rewarding endeavor for beginners willing to put in the effort to learn. By understanding the fundamental concepts, developing a solid trading plan, and managing risk effectively, you can embark on a successful trading journey. Remember, even experienced traders face challenges, so stay patient and keep learning. Good luck on your Forex trading adventure!